Leapfrog! New laws are being adopted, then repealed, dozens of proposals are constantly coming from various angles, from the leadership of the customs to the Ministry of Economic Development. The conditions for the transportation of parcels change with unenviable regularity. Here is a summary of this corps de ballet, if interested.

Now the conditions for 2020 have finally taken shape. We are waiting for a new cut in the duty-free limit and, in general, more stringent rules. But in attempts to limit foreign online purchases, the government and AKIT this time may have the opposite effect.

What now

Since the beginning of 2019, Russians have been paying duties on the import of online purchases from abroad of more than € 500 (about $ 555). This should be the total cost of all orders per person for a month, while the total weight of the parcels should not exceed 31 kg.

Before this, it was possible to import duty-free purchases worth up to € 1000 per month - such rules have been in force since the beginning of 2010. Changing the rules yielded results. According to the results of the first quarter of 2019, the volume of fees paid by Russians for purchases in foreign online stores amounted to 200 million rubles, which is three times more than the figure for the same period of the previous year.

But the share of foreign online commerce in Russia continues to grow. It is already more than 40% (over 530 billion rubles). The largest Russian retailers, having united in the AKIT organization, have been lobbying for several years to tighten the nuts by any methods. Ideally, to buy goods it was possible only within the country.

The rules for customers are changing gradually, the nuts are tightened at one revolution per year. And here we once again brought a wrench :)

What will happen from January 1

From the beginning of 2020, purchases from € 200 (instead of € 500) will be levied on duties. At the same time, the duty rate will decrease from 30% to 15% of the customs value.

Parcel weight - as before, no more than 31 kg. If it is exceeded, you will be charged 2 euros for each "extra" kilogram. Moreover, if both the weight and the cost of the parcel are exceeded, the highest duty of the two will be charged (fortunately, one).

Another innovation - if earlier the duty was calculated on the sum of all parcels per month, now it is individual for each order. That is, you can order at least 10 parcels of 199 euros each, and not pay the fee. True, if parcels arrive at customs as part of one consignment, they can be interpreted as one shipment, so every day it is better not to make many large orders from other countries.

What does it mean for purchases from China

The wrench turned out to be defective.

The law was mainly passed against Chinese stores, from which there are a lot of cheap goods. As the Association of Internet Commerce Companies (AKIT) itself reported in 2017, 22 euros is the bar for which 61.4% of Russian purchases in foreign online stores do not go. And nothing will happen to these purchases. If you buy a trifle, like towels and covers for a smartphone, nothing changes.

The most affected segment is from € 200 to € 500, which now will have to pay a fee. This will affect smartphones, tablets, laptops. The duty is small, but the very concept of interaction with customs scares away many. However, in the next year, Russians will inevitably have to deal with this state agency more often.

Payment of duty is a fairly simple process. You have several options:

Make payment through the bank. To do this, you need to get a receipt with the details and make a transfer in the department. It is important to fill in all the payment details correctly, otherwise the funds cannot be taken into account by the TCF, and the parcel will still remain at customs.

If your parcel is delivered by Russian Post, and it is subject to payment of customs payments, the shipment arrives with a customs receipt order (TPO) and a receipt. You can pay the receipt by any convenient method. Russian Post has announced the launch of its own online payment service from November 1, 2018, but the technology is still in test mode and is not available to a wide range of users.

The fee can be paid using special terminals installed at customs posts. The customs payment receipt contains a special bar code. It is read by the terminal scanner, automatically loading all the payment details, so that data can not be entered manually. Paid by regular credit card.

For individuals , the Pay HD operator of the Multiservice Payment System operates. It allows you to find customs receipts for details and pay them online. To do this, specify the name, series and number of the passport, and the service will automatically download the available receipts. You can pay by credit card. Not yet available for all parcels (it is necessary that they be entered into the system at customs). But if the new conditions make the service develop, ideally all receipts will be loaded here automatically.

If you refuse to pay the fee, the purchase will go back to the store after a 10-day period. It is impossible to receive a parcel without paying a fee. This is a mandatory payment, like taxes. At the same time, the online store has the right not to return money to you for the purchase.

In general, for most parcels, the new conditions do not work, they are useless. And we are not talking about the fact that when shipped, Chinese stores tend to indicate prices much lower than real prices in documents.

What does it mean for purchases from America

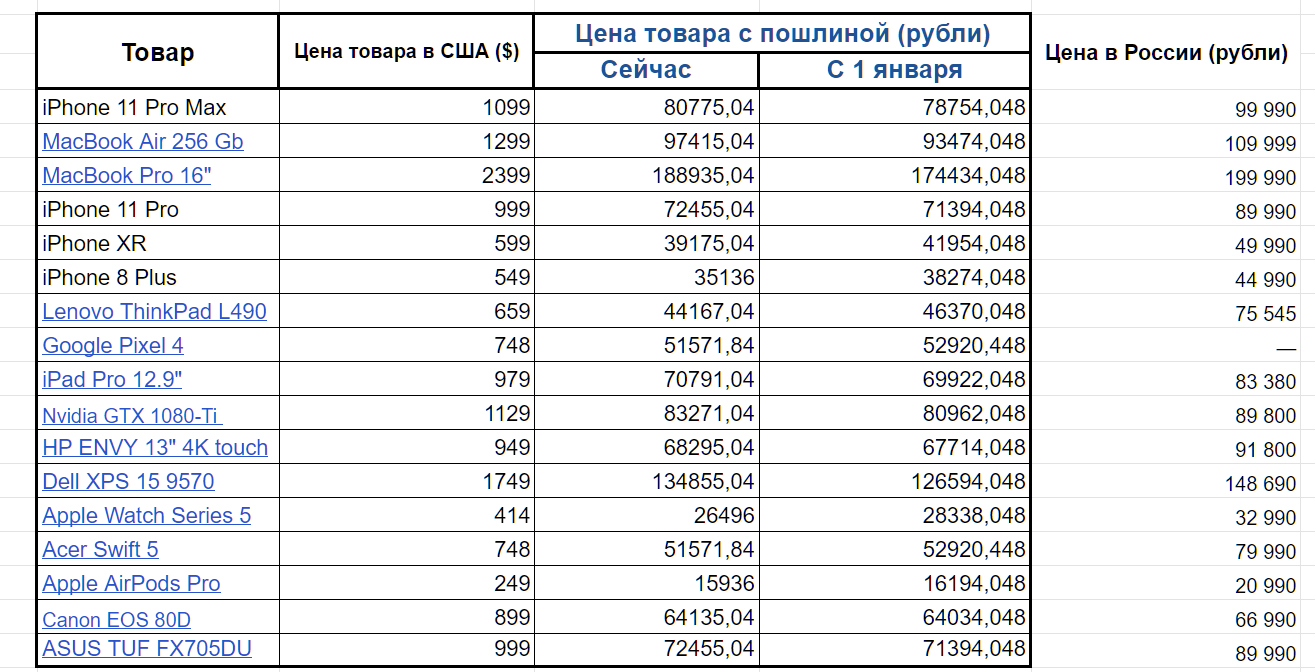

In some cases, buying becomes more profitable - due to a reduction in duty rates from 30% to 15%. Apple technology, macbooks, expensive clothes and other products that cost significantly more than € 500 will now be cheaper for Russians. Sometimes the savings are very substantial. A striking example is the new MacBook Pro 16 ". In Russia it costs 199,990 rubles, in the US $ 2,399. Previously, it would have been 189 thousand rubles with a duty, now it will be 174 thousand. Almost 15 thousand rubles are saved thanks to the new rules.

A segment from € 200 to € 500 will suffer. This is the Apple Watch (if without discounts), some iPad, part of the inexpensive laptops from HP and Dell. Otherwise, most parcels are either cheaper than € 200 (toys, sneakers, clothes), or more expensive than € 500 (iPhones, macbooks, top-end laptops, etc.).

Moreover, it should be borne in mind that the duty on goods exceeding the amount of € 200 - it turns out very modest. For a gadget priced at $ 250, it will be only four dollars. But the saving of 15% for expensive parcels is very tangible. It can be tens or even hundreds of dollars.

Here is a small comparison chart :

As you can see, in fact, of course, the cut-off point is not € 500, but € 800 (about $ 885). Considering that earlier for a product priced at € 560, a fee was taken from € 60, and now they will take even a lower percentage, but from € 360. Therefore, the average price segment suffers even more than one might think. But there are not so many goods on it.

In addition, the plus is that the duty-free limit now goes for each parcel, and not for a whole month. For example, semi-commercial clients, “electronic shuttles” who order New Balance sneakers through us every day for resale, used to have to import goods to different addresses, take documents from acquaintances and relatives, dance with a tambourine and hope for good luck. And now they can order any number of parcels. If each parcel costs up to € 200, there is no need to pay fees. Business is booming. Expect even more offers on VK and Avito.

Of course, the parcels should not arrive at customs at the same time, that is, they should not be sent in one batch (otherwise they can be counted as one). But this almost never happens with us - either free consolidation of packages into one at the request of the client, or sending with a period of 2-3 days.

Well, the Russian market, even in the price segment of “from € 200 to about € 800”, remains uncompetitive. We have already examined that even if you introduce 15% for everything, even without a lower limit, prices in Russia remain too high. Apple appliances in the Russian Federation are more expensive than in the US by 34%. Gadgets and electronics average 47%. And the biggest cheat is observed for fashionable clothes and shoes - up to + 149% for some brands. A duty of 15% here does not save.

Moreover, if you remember, from July 1, 2020 Apple may even leave the Russian market - if they try to force it to preinstall Russian software . In this case, buying these gadgets will be possible only abroad.

Paying a duty for goods from America is even easier. Many express carriers provide a service that allows you to pay online, directly in your account and using a regular bank card. You can also pay through us at the local branch of Russian Post or (for FastBox and Pochtoy Express methods) by check from e-mail, online banking. If the order has exceeded the limit of duty-free import, and this was found at customs, an email will be sent to the email with a link to the portal for payment.

If you bought at discounts, as often happens, it is useful to store an invoice (e-mail that came to you from the store). He will confirm that the price of the goods was actually lower than usual. And ideally, we also advise customers to take screenshots of purchases. “Notarized screenshots” ™ can really be an argument when dealing with customs, and save you a couple thousand rubles. Bank statements or links to the product page are also useful.

Customs payments are paid, if necessary, only if their value is more than 2 euros. Payment is made in rubles at the Central Bank rate. After payment, customs issues the parcel on average within two days.