There is such an opportunity and is quite legal. Not all of our state and banks have levied taxes and commissions so that lovers of big state cones would fly private planes on their 62-meter yachts. Use until you cover.

From the article you will learn what problems a business faces when paying for freelance work, how to relate these costs to expenses, how to pay from an organization’s bank account, what documents and how to compose, as well as sample documents.

Problem detail

Many companies work with freelancers.

Firstly, because with frames ★ ◯ □ △. Secondly, because it is in some cases cheaper and faster when you need to perform a non-core task of narrow specialization.

The main problem is how an entrepreneur can pay for work with minimal losses on taxes and commissions. Russian freelancers can be asked and even required to register as an individual entrepreneur or self-employed. According to the law, they are required to register. But many do not want this, as we will see later, their huge minus in front of foreign freelancers.

It is more difficult with freelancers from abroad: the problem is to send money and document everything.

Here is an example of the details that a freelancer sends:

IBAN: UA063220010000026204503011111

Account No: 5333314119999911

Receiver: Vasya Ivanov, Ukraine, reg. Kharkivska, c. Kharkiv, st. ***, build. ***, fl. ***

payee's bank

Bank: JSC UNIVERSAL BANK

City: KYIV, UKRAINE

K / account: 16003000300001Bank intermediary

Bank: TASKOMBANK JSC

City: KIEV, UKRAINE

Account: 30111810500000000292 Recipient correspondent

Bank: Sberbank of Russia PJSC

City: MOSCOW, RUSSIA

TIN: 7707083893

BIC: 44525225

C / Account: 30101810400000000225 TO THE OPERA OF THE MOSCOW STU BANK OF RUSSIA

No to SWIFT and IBAN. And then there is IBAN, but then some frightening trash, which is not very clear how to properly shove into the form of a payment order in the personal account of a Russian bank.

Hence the wild amount of all kinds of services, exchanges and payment systems, which sometimes take wild commissions for transferring money, and this money itself cannot be taken for expense due to the lack of necessary closing documents and it is unclear how to get it from the current account without paying taxes. The advantage of payment systems is that they don’t lose their brains and allow you to make transfers using bank cards. Why banks are so complicated with non-cash transfers is incomprehensible.

But it turns out that everything can be done legally without transfers from card to card or without paying a commission at the 6% freelancers exchange, which also takes 15% from the freelancer.

When we in ITSOFT web studio needed the help of a specialist for a specific task, we also suffered and looked for ways to transfer money to a freelancer in Ukraine. There is also Alfa Bank. But you can’t send money to Ukrainian from the Russian Alfa Bank or through the Russian Alfa Bank easily and simply. In any case, they did not help us in supporting Alfa Bank of the Ukrainian bank. One plus of the Ukrainian Alfa Bank over the Russian one is that you can call there using Skype and a bunch of other messengers and you do not need to spend money on intercity.

Among the well-known translation options:

- Transfers from card to card for 1.5% and conversions on the course.

- Transfers by all kinds of payment systems and intermediaries with commissions.

All these options did not allow to write off costs to expenses. This caused our just anger. In the days of the USSR, bank transfers surely went all over the Union as they now go inside Russia. A freelancer from Ukraine also sent some strange details, which are completely unclear how to insert into the form of a Russian payment order in a bank.

After much torment, we found a solution. It turns out that the casket just opened.

Description of solution with links to laws

The Ministry of Labor of the Russian Federation clarifies that the Labor Code of the Russian Federation does not provide for the possibility of concluding an employment contract on remote work with foreign citizens operating outside the Russian Federation (letter of the Ministry of Labor of the Russian Federation of 07.08.2015 No. 17-3 / B-410). There, the Ministry of Labor recommends cooperating with this category of individuals within the framework of civil law relations.

Therefore, all we need is to conclude a contract for the provision of services between the organization, as a customer and a foreign citizen, as an executor.

It should be noted that such an agreement should not contain conditions indicating the existence of an employment relationship. Therefore, no working days and times. In the conditions final results and total cost of services are registered.

The most important thing for us is that when concluding an agreement with a foreign citizen in accordance with paragraphs 6, paragraph 3 of Article 208 of the Tax Code of the Russian Federation, remuneration for a service provided outside the Russian Federation is recognized as income from sources outside the Russian Federation and is not subject to taxation in the Russian Federation (letters of the Federal Tax Service No. ED-3-3 / 384 @ of February 6, 2013 and the Ministry of Finance No. 03-04-06- 01/206 of 08/11/2009) and, accordingly, the organization does not have the obligation to act as a tax agent, as, for example, when concluding the same contract with a citizen of the Russian Federation. Therefore, the organization does not pay personal income tax.

Also, when concluding such an agreement, there is no obligation to pay insurance premiums (Clause 5, Article 420 of the Tax Code of the Russian Federation).

In this situation, all the duties of paying taxes fall on the shoulders of the freelancer himself in the framework of the legislation of the country of which he is a resident.

Settlements are made through a settlement account. Be sure to pass currency control. The bank will ask you for an agreement with the contractor. It should indicate its value equal to the amount of the payment order.

It is also possible to conclude a framework agreement and, at each payment, sign an act on the provision of services with the freelancer. One payment - one act. It must be signed on both sides. Such an act will simultaneously be a closing document.

When working on the simplified tax system, payments under the contract can be accepted for expenses.

Before signing an agreement, ask your bank what details you need to fill out when transferring the amount in rubles to a foreign counterparty. If the counterparty is from Ukraine, indicate this in the question. For this category, there are additional details. They must be reflected in the contract.

When requesting details from a freelancer, ask him to make a request to his bank, requesting specifically details for transfers from Russia.

After the contract is completed, the matter will remain small: fill out the payment order and attach (or send separately to the bank) the contract or act for the amount of payment.

Sample Documents

Samples of the contract and act for working with a foreign freelancer you can download from the

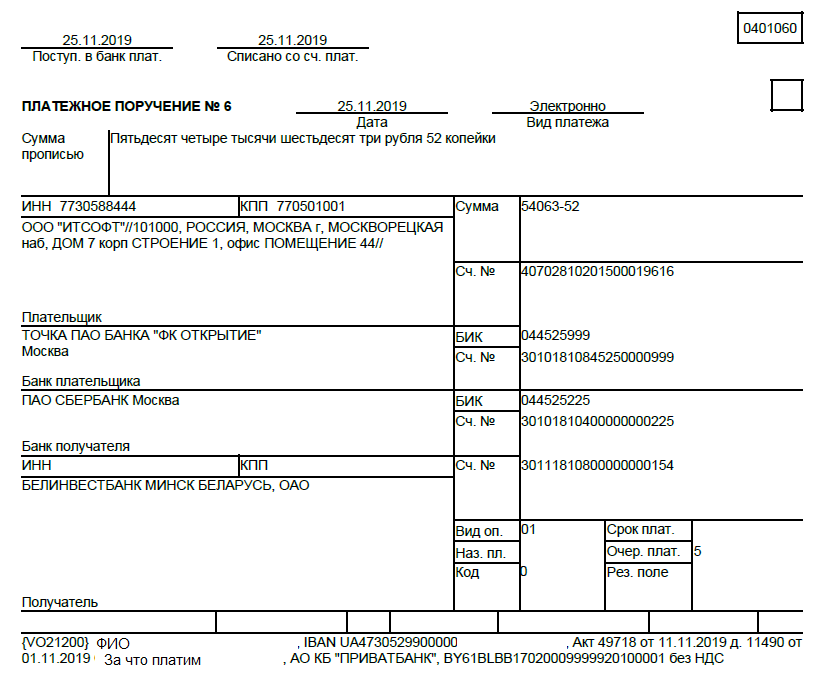

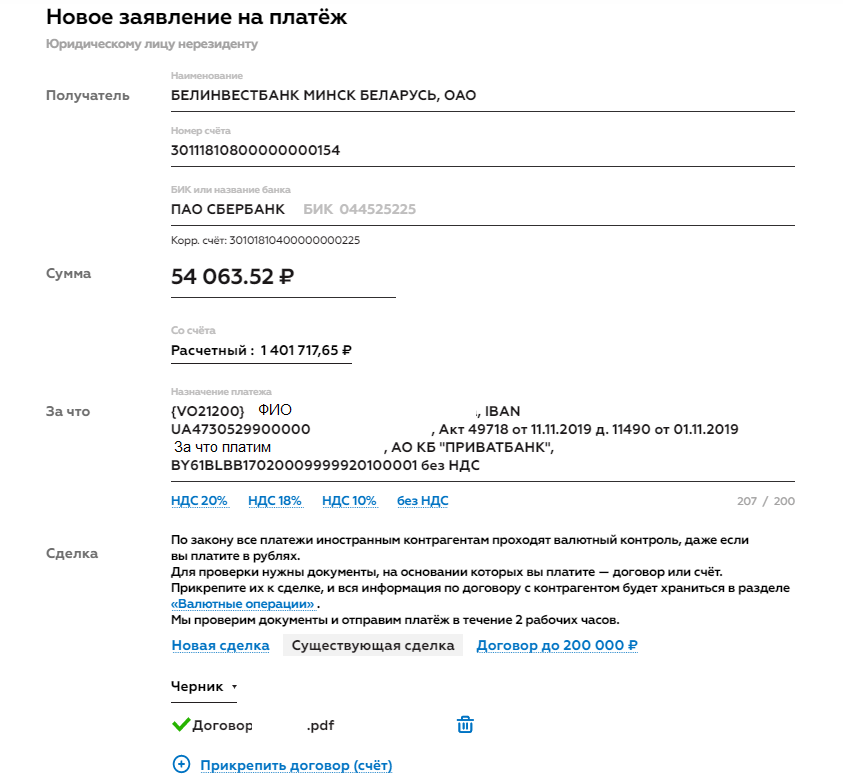

site , other samples of contracts and documents for creating sites are also available there. And this is what a payment order looks like

and as a form for filling it in the bank Point

Contract currency

It is also important to note that the contract can be concluded in any currency. And these options have their pros and cons. When changing course, someone will lose, someone will win. Freelancers count in dollars. At the same time, the ruble is strengthening, over the past year it has strengthened by 7% and it is more profitable to pay in dollars now. Russia's gold reserves 540 yards and in the next 2020 is likely to reach an absolute historic maximum and exceed even 600 yards. I would believe in the ruble and pay dollars in the near future. But on the horizon of several years, as our history teaches, it is better to believe in dollars and conclude contracts in rubles.

conclusions

So, it turns out that hiring foreign freelancers is even more profitable than Russian ones if the Russians are not registered as an individual entrepreneur or self-employed and do not accept payment by bank transfer with the issuance of acts on the provision of services.

Share in the comments how your organization pays for the services of freelancers.